Featured Projects

Some stuff I've tinkered with

Startup Studio

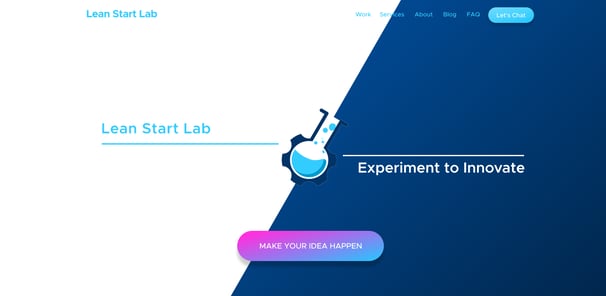

Lean Start Lab

I love startups and obsess with taking things from 0 to 1. Lean Start Lab is the manifestation of that obsession.

I've helped dozens of early-stage startups test their ideas, raise seed funding, and launch MVPs 🚀

Startup MVP Go-To-Market

Full Stack Web App

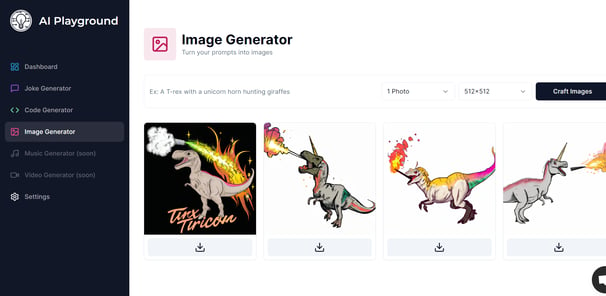

AI Playground

The best way to learn AI is to play with it.

That's my motto for AI Playground, a collection of simple AI tools for people (mostly my university friends) to experience gen-AI for themselves while having fun with it.

OpenAI React Next.js

Healthcare SaaS Platform

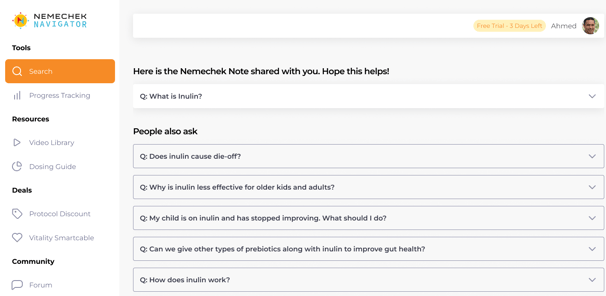

Nemechek Navigator

A searchable knowledge base for Dr. Nemechek's content.

Designed for on-demand Q&A through a Google-like interface, the platform has seen 60,000+ questions asked and answered since launch, helping patients achieve speedier recovery.

OpenSearch Airtable Mixpanel

Financial Data Analysis

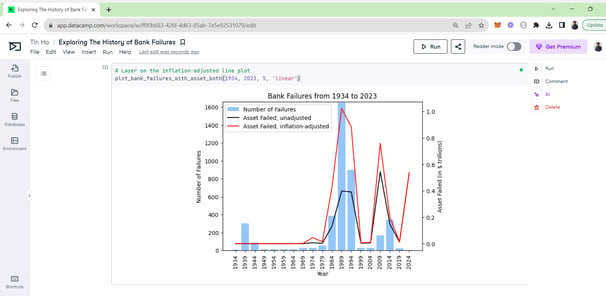

US Banking Failures

In the midst of the Silicon Valley Bank collapse, I was curious about the history of US banking failures.

So I used Python (and ChatGPT) to crunch the numbers on 100+ years of data, then wrote a report + a tweet storm.

Python ChatGPT DataViz

Software Solution Research

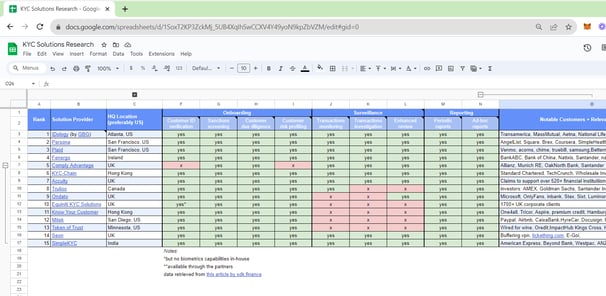

Insurance KYC/AML

Know-Your-Customer (KYC) / Anti-Money-Laundering (AML) is crucial for a multibillion-dollar insurance company.

To help them modernize the onboarding experience, I put together a vetted list of KYC/AML vendors.

KYC/AML AI Cybersecurity

Finance Capstone

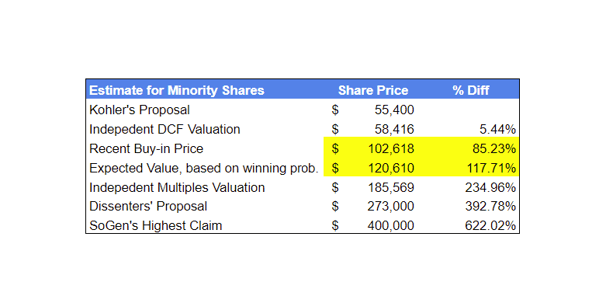

Kohler Valuation

A comprehensive valuation exercise of Kohler's minority share, this case forced me to use all of the financial analysis techniques I learned during my Master of Finance, as a capstone project should. Now I'm an MF 😉.

DCF Multiples WACC

Financial Simulations

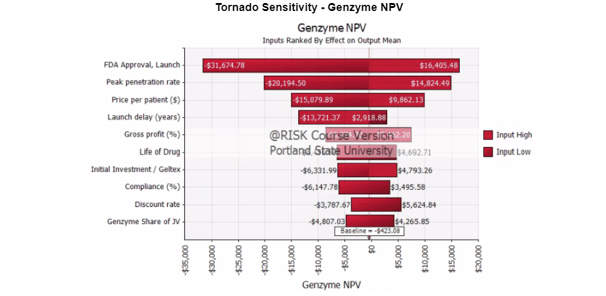

Monte Carlo Simulation

Financial modeling is nothing more than making educated guesses, so instead of making just 5 or 10 such guesses, why not make 1,000 or even 10,000 of them?

That's where the Monte Carlo Simulation comes in.

Monte Carlo Tornado Pharma

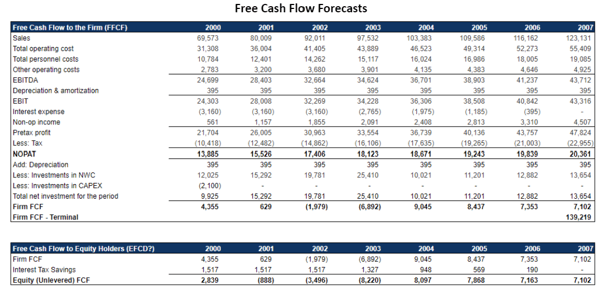

Financial Forecast

Adjusted Present Value

It's tough to value a company who is changing how it uses debt with a traditional Discounted Cash Flow (DCF) model.

I used the Adjusted Present Value (APV) method to separate the value of the company and of its debt use into 2 parts.